Blistering November Gains for Stock Markets Even As Covid Rages On

Dec 1, 2020

USA stock markets hit record highs in November 2020

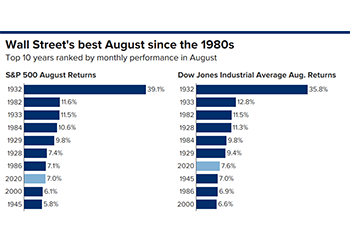

Enthusiasm about vaccines drove USA stock markets to record highs in November 2020.

- The Standard & Poor’s (S&P 500) rose 11%, its best November ever.

- The Dow Jones Industrial Average (DJIA) gained 12% for its best month since 1987.

- The Nasdaq Composite rose 12% for its best November since 2001.

Source: Trading Economics

Will the markets stay calm and carry on?

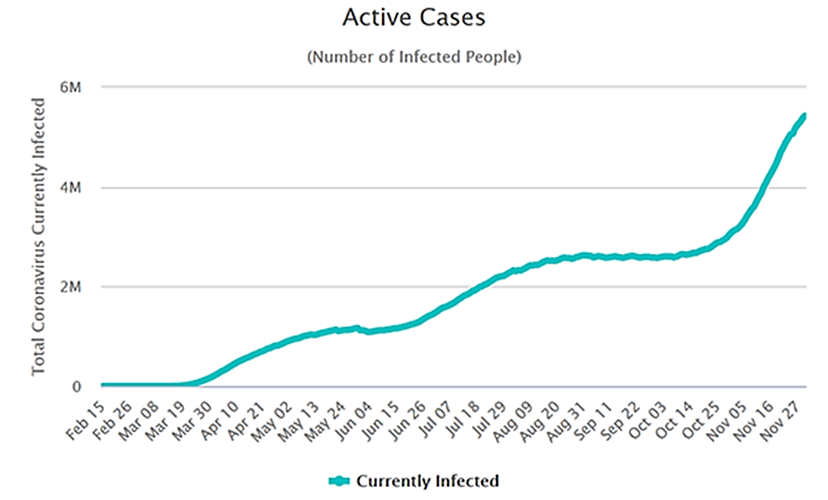

Despite the market gains, Covid rages on. The chart below does not show USA stock markets but the number of USA active Covid cases! Seems like Covid wants to follow the USA markets! A Covid surge is expected in December as Americans return from Thanksgiving

Source: worldometers.info

If Covid vaccines optimism has buoyed stock markets, let’s be clear - currently, no vaccine is yet available. Regulators and pharma companies across the globe are racing to offer vaccines. In fact, the vaccines being fast forwarded are interesting in its novelty itself – with those touted to be most ready soon – being in the category of mRNA vaccines. Usually, vaccines put a weakened or inactivated germ into our bodies to trigger an immune response and produce anti-bodies. Instead, mRNA vaccines teach human cells how to make a protein that triggers an immune to produce antibodies to recognize and fight the Covid virus when infected. Vaccines are not a silver bullet. It has to cope with different Covid strains and mutations. There is also nascent anti-vaccine movements fuelled by conspiracy theories. Trust is all important.

Global Leadership Vacancy Awaits Biden…

The Covid pandemic is a global problem. It needs global cooperation. It is not sufficient for any one or a few countries to control the infection domestically. If there is a weak link, or worse, many weak links, the global economy will struggle to recover.

As the world watches for useful signs of what the future may look like following the media declaration of Democrat candidate Joe Biden as the President-elect, uncertainty weighs on who will control the US Senate until the Georgia run-off on Jan 5. Meanwhile, Congress remains hamstrung on a stimulus package due to a divisive political situation while the incoming Biden team is taking shape, the latest being the nomination of Janet Yellen, former Fed Reserve Chairperson as the Treasury Secretary. An old hand, Yellen’s nomination seems to cheer Wall Street into 2021. I don’t think it’s that simple.

Hopefully, 2021 will see more constructive multi-lateral global cooperation to coordinate economic stimulus and restore the Covid-battered economies. It will take time as Covid does not seem to be bedding down anytime soon, given the lackluster handling across many countries, particularly the USA. What is painful is the poor and lower income workers suffering the most.

China matters too…

Any global investor must pay due attention to China. What worries is that while China’s Covid situation is stable and the economy seem to be regaining its legs, there are signs of strain.

For instance, we are seeing a wave of bond defaults and bond issuance cancellations across China’s state-owned enterprises (SOEs). Nationwide, 100 billion yuan (USD 15 billion) of corporate bond issuances were either canceled or delayed in November, up from 34 billion yuan in October and from 28 billion yuan in the same period last year. This has sent shockwaves through China’s corporate bond market. The glassy thought that China will never let SOEs default has been shattered. At least, the gleaming sharp point is that China appears to be allowing market forces do its job to instill discipline in the SOEs. That is, no SOE should be allowed to keep borrowing to grow, and worse, keep borrowing new debt to repay old ones. That should be positive in the longer-term but spells short-term pain.

On the economic front, China continued to recover as manufacturing achieved its fastest growth in a decade.

The Nov 2020 Caixin China General Manufacturing Purchasing Managers’ Index (PMI) reading was the highest since 2010 and marked the seventh consecutive month of expansion. Total new orders and output hit 10-year highs. This should bode well for ASEAN.

As Global Debt Piles Up…

Interestingly, while Covid has arguably accelerated digitalization in how we work, live and play, it has also added fertilizer to how we pay and move money digitally. In fact, as governments across the world sent money to citizens as if thrown from a helicopter, global debt has reached proportions never seen by economists and accountants. But debt collectors must be rubbing their hands in glee! Problem is, I think they will be unable to collect!

Unlike exceptions such as Singapore, every country has had to borrow to support their people as jobs and incomes evaporated due to lockdowns to fight the Covid pandemic. What I thought was mind-boggling USA government debt during the 2008 Global Financial Crisis is “peanut” size compared to what the USA now has chalked up. A surge in spending to mitigate the health and economic impacts of the pandemic has brought the total public debt in the USA to 100 per cent of GDP. Almost 20 percent of USA corporations have become zombie companies unable to generate enough cash flow to service even the interest on their debt, and only survive thanks to continued loans and bailouts. The Biden Administration will need to act quickly to avoid outright default scenarios at home and abroad. This will be a burden on recovery across the world and raises even more of “the Emperor has no clothes on” dilemmas – the USA dollar in theory should be a “banana currency” by now.

Even before the COVID-19 pandemic paralyzed economies around the world, economists were warning about unsustainable debt in many countries. Total global debt stands at an unsustainable 320 percent of GDP. Here, China gets the spotlight as the largest foreign lender not only to the USA, but to many emerging economies. I see more USA-China tension ahead.

…Digital Currency Shoots are showing!

Piling debt on top of debt seems to have reached a dead end. A growing number of economists and policymakers are beginning to talk about the need to shift to a new, possibly digital monetary regime, with implications for financial, social, and political instability.

Here, I believe crypto will play an increasing role. As acceptance and reality bites, it is likely that crypto assets previously shunned by the mainstream – such as the more famous Bitcoin and Ethereum will begin to trade with more stability. I see more mainstream asset managers adding such crypto assets to their asset allocation as part of wealth management.

Let’s stay calm and masked!

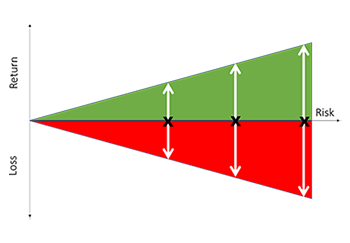

Notwithstanding, we have learnt in every crisis, that there are bright spots. In the ranking of all poor performers, there are always those who rank at the top of the class. This is the case in investing (not trading) which takes a longer-term time horizon in riding out volatilities. And that is exactly how SquirrelSave is designed for. If you want short-term gains without considering the risks taken, then trading is the best behaviour.

At SquirrelSave, we prefer to invest with the aim of good risk-adjusted investment returns. SquirrelSave allows you to start with any amount, even ONE Dollar! You spend even more for one meal! No special knowledge needed or trading decisions. We do all the work. Enjoy low fees compared to traditional investment products. And yes, you can withdraw anytime.

Is there “The Best Time to Invest?” My answer is - just start investing (not trade) and do so with regular top-ups. Choose your risk setting so that you are prepared to ride the inevitable market volatility. Remember, market volatility contributes to potential investment returns. Focus on investing for more than one year. If you are prepared to ride out the bumps over a time horizon of two to three years, you can invest with confidence.

Open a SquirrelSave account at www.squirrelsave.com.sg or download our mobile app from the Apple or Google app stores.

Regards

Victor Lye CFA CFP®

Founder & CEO, SquirrelSave

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing. Past performance is not necessarily indicative of future results. All investments carry risk and all investment decisions of an individual remain the responsibility of that individual. All investors are advised to fully understand all risks associated with any kind of investing they choose to do. Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all return examples provided in our websites and publications are based on hypothetical or simulated investing. We make no representations or warranties that any investor will, or is likely to, achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results.

More Articles more

Risk Management Still Critical - As It Always Has @ SquirrelSave

Team SquirrelSave

In the past two weeks, the stock market has become choppy. Headlines scream about the largest fall since whenever. That’s obvious, right?

Read more

The Best Time to Invest?

Team SquirrelSave

Sorry to burst your bubble. There is no such thing as the best time to invest, unless you are a historian.

Read more

Market Update – 1 Sep 2020

Team SquirrelSave

August 2020 has seen a recovery. While DJIA remains around 4% below its pre-Covid high, the S&P500 has finally broken through and setting new record highs.

Read more