Market Update Mar 2020

March 2, 2020

Fear Takes Over with Saturation Media Coverage of the COVID-19 Outbreak…

What a horrible week! Major benchmark indices such as the Dow, S&P 500 and Nasdaq had the worst week since the Global Financial Crisis of October 2008, entering correction territory along with European and Asia-Pacific markets. Crude oil prices fell 14% in a week while the benchmark US 10-year Treasury yield hit an all-time low of 1.19%.

We've been here before.

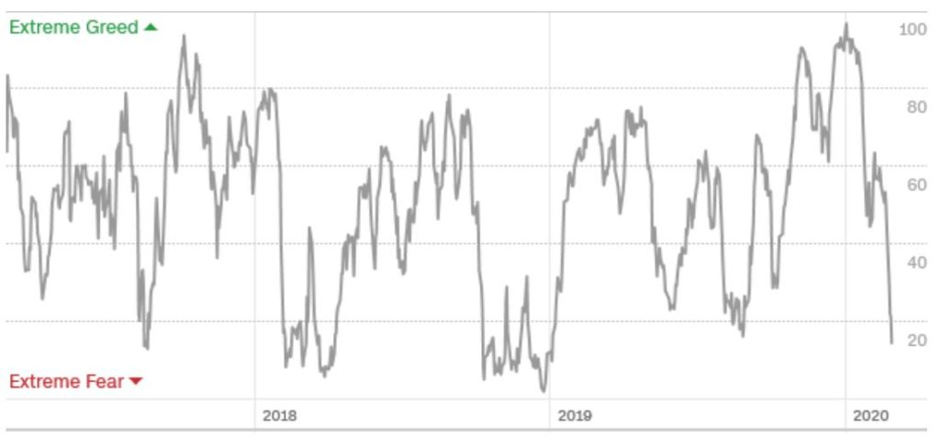

I mean the surreal experience of investor mood swings between euphoric greed and blind fear. The CNN Fear And Greed Index has retraced from extreme greed levels in January to deep fear levels.

CNN Fear And Greed Index

Just weeks ago, when China was taking the most unprecedented and draconian (by Western democratic standards) measures to quarantine an entire city, the Dow Jones and Nasdaq were hitting new record highs.

Coronavirus pandemic being priced in…

Suddenly, the markets have been unravelled by the spread of the Coronavirus to almost every part of the world. It should not be a surprise as the patterns were already evident and the possibility of widespread transmission was touted at the outset by the World Health Organisation (WHO). The market seems to be pricing in the impact of enforced quarantines in major economic producing countries and lost production that will ultimately dent the global economy.

While it is too early to quantify the downturn in economic activity, it is realistic to expect a sharp downward shock to the Chinese economy during the first quarter, followed by recovery during the second quarter and second half.

Overall, the investment market is pricing in risks of economic recession due to the Coronavirus shifting from a China epidemic to a global Pandemic.

Let’s be rational while people panic…

With the worst week since the Global Financial Crisis, it is fair to say that the market is in a state of panic. I believe this is short term as the market is probably oversold. A correction should be expected with or without the coronavirus crisis, since the market was too overbought in January and early February.

Even with my 25+ years of navigating investment markets, I am still having to learn that shrewd investors buy in times of pessimism and sell in times of optimism. But human impulses and emotions mess up investment decisions.

Thankfully, at SquirrelSave, our machine learning AI engine does not have emotions clouding rational investing. Understandably, human investors will be spooked by the relentless 24/7 media coverage. After all, fear sells. Hence, the media will bask in its business of grabbing attention and advertising.

Stay the course - as long as your risks are objectively managed…

You should stick to your investment plan through the market ups and downs. The stock market is a fascinating beast, changing with technology and information flow. But markets are ultimately driven by humans, who are emotional creatures.

To be a shrewd investor, make emotions work for you and not against you. Investors tend to exaggerate when they express panic or euphoria. When everyone is pessimistic, chances are that the future will not be as bad. When everyone is optimistic, chances are that the future will not be as good.

Hence, we need to invest when everyone is feeling fearful. On the other hand, we need to sell when everyone is feeling euphoric. Evidence suggests that this strategy significantly increases the chances of success over the long term.

In short, the Coronavirus will impact the global economy. But history and data show that the market eventually recovers.

Investment requires discipline and commitment…

There is never a good time to invest. You must decide to invest in a disciplined way. Do not trade by timing the market. In investing, first, decide your risk appetite and then invest. If the volatility causes you to throw up, you have chosen the wrong risk level.

As I noted in my Oct 2019 Market Update, our machine learning algorithms shifted significant asset allocation into GOLD probably on rising global risks.

This helped stabilise portfolio volatility while contributing to overall portfolio performance.

As the Coronavirus situation was developing in Jan 2020, our machine learning algorithms have since shifted more allocation to cash.

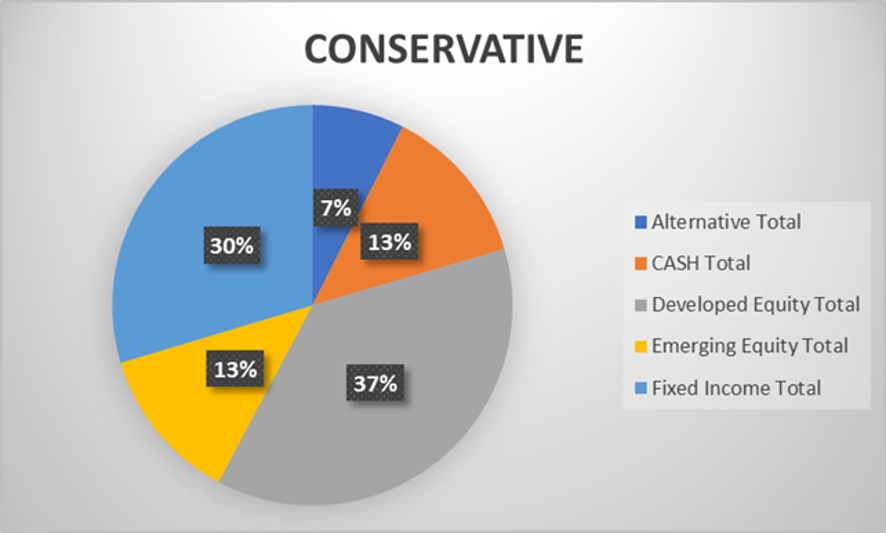

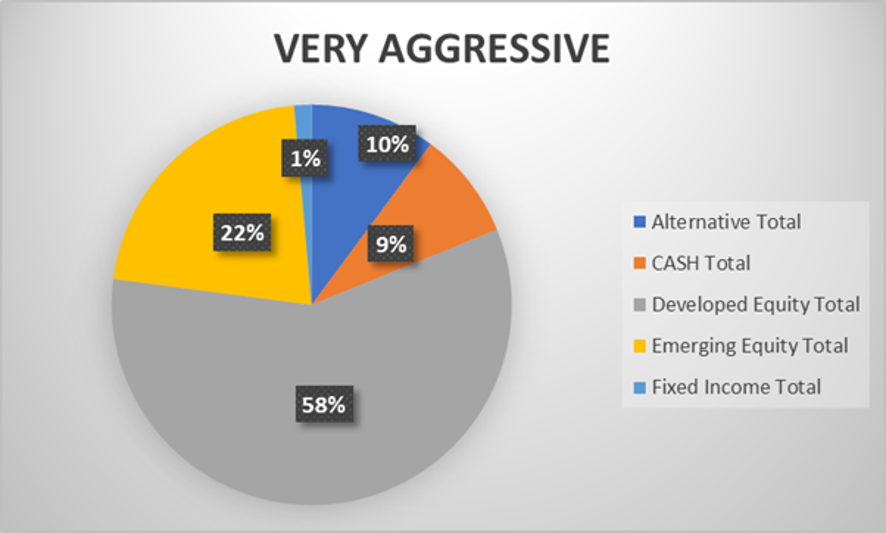

This helped to preserve gains while reducing risk exposure. For example, our SquirrelSave “Very Aggressive” portfolio holds 9% cash while the “Conservative” portfolio holds 13% cash!

Managing Investment Risks is Key

If you are invested, manage your risk exposure. If you are not invested, the Coronavirus fear is a good opportunity to start building up your exposure.

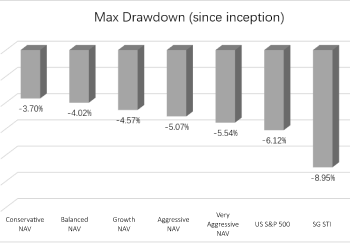

At SquirrelSave, we use machine learning AI to predicts risks and returns using real-time data. We prefer not to cloud our decisions with human emotions as markets face volatility.

Our machine learning AI computes faster than any human manager and can recognise patterns which seem random to the human eye. Yet, through all this market noise and chaos, SquirrelSave AI remembers you – individually – in terms of your personal risk appetite always. It does not matter how much you have invested. Our SquirrelSave AI treats you the same – whether you invested $100 or $1 million.

It’s when markets really become volatile that the forward-looking, disciplined and non-emotional processes make the most long-term sense and better risk-adjusted returns.

More Articles more

Stop Paying for Bad Performance

Team SquirrelSave

In the investment world, those who

have more money pay the lowest

fees. Those who have less money to

invest - pay much more. It’s painful to

see how these small investors are...

Read more

How Covid-19 Affects Investment Strategy

Team SquirrelSave

As with any flu outbreak, the spread of

corona virus infections will peak & slow

down. But what about our

investments?

Read more

SquirrelSave portfolios are doing fine despite Covid-19

Team SquirrelSave

Despite the world fighting the Covid-19 outbreak, SquirrelSave's portfolios are still showing positive

performance. Our investments are well-diversified across global markets.

Read more