Is Covid-19 different from the past crisis?

March 30, 2020

Yes, Covid-19 is different from the causes of previous crises. There is deliberate policy-induced economic contraction – unlike other crises.

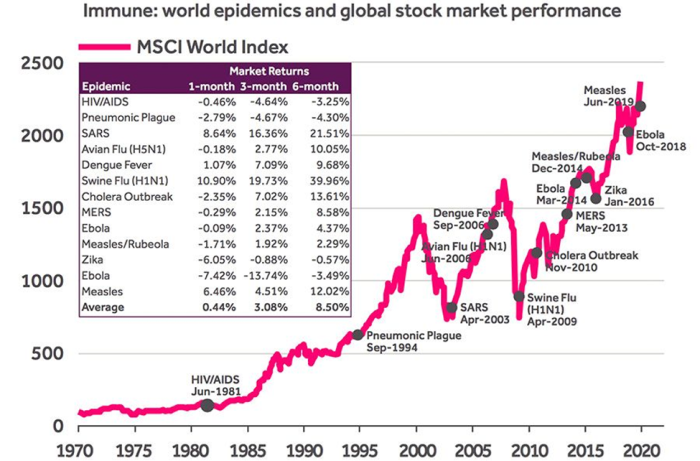

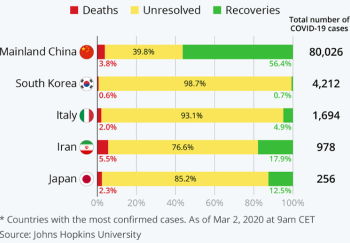

Historically, the world has seen several biological outbreaks in the last 50 years. The 2002-03 outbreak of SARS (also a coronavirus) did not affect stock markets. The S&P 500 gained 15% in April 2003 and gained 21% a year later. The fear of SARS was not enough to derail the market. Middle East Respiratory Syndrome (MERS) similarly saw a 10% rise and almost 18% a year later. SARS and MERS (both coronaviruses) were relatively well-contained.

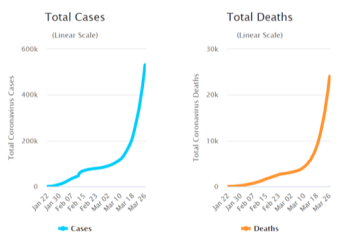

Though Covid-19 is statistically less lethal, it has spread so fast that worldwide infections and deaths now surpass SARS and MERS combined. Hence, the economic impact is in uncharted waters.

Financial markets reflect future expectations. A Covid-19 vaccine will take at least 18 months. To counter the sudden massive collapse in economic activity, strong government fiscal and monetary responses are needed. Bolstering the purchasing power of middle and low-income households who spend the largest portion of income – can stimulate economic activity.

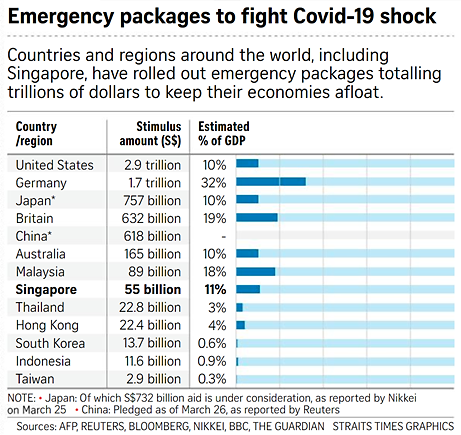

So far, the global fiscal and monetary responses to Covid-19 are unprecedented.

On 26 March 2020, the Group of 20 major economies pledged to inject USD 5 trillion in fiscal spending into the global economy and "do whatever it takes to overcome the pandemic". This show of unity – lacking since the 2008-2009 Global Financial Crisis that led to the G20's creation – is comforting.

Across the world, there are bold fiscal packages which aim to put cash directly into consumers’ wallets, cushion lost income and fight job losses.

What should you do?

Investing during a crisis is usually a good bet - no pun intended :). For new investors and millennials, this is your first financial crisis to live through. If you have not invested before, this financial crash is what many older investors like me have seen. It’s time for you to start.

For those who are truly invested – with clarity on the time horizon and your risk tolerance - stay the course, unless you were speculating and holding on to naked unhealthy gambles. I can’t help much there. But you will need pressurized ICU ventilators!

For those who are contemplating unit trusts, please consider the minimum investment sizes and high expense ratios. There are alternatives like SquirrelSave now available.

Don’t let emotions win over reason. It is foolish to sell into a crisis.

Consider this. In every past crisis, investors felt confused, uncertain and panicky. Nothing would help them cope with the ominous world they faced. The typical bad advice was: “sell now, before it’s too late. Save what capital you have left.” Now, writing this to you, it is easy to confirm that such advice – if followed - had turned out to be completely wrong.

Of course, I don’t really know when the exact bottom will be reached. But experience says that even if you miss the bottom, your gains should be good if you take a 1 to 3-year time horizon. This is the time horizon that our SquirrelSave AI is designed for.

If it’s any consolation, all past crises ended. The markets always bounced back. Unless we see the end of the world, why ignore the data?

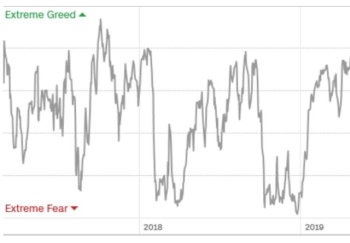

The Sage of Omaha on Opportunities in Crises – Greed and Fear

In 2014, legendary investor Warren Buffett, the “Sage of Omaha” shared that his last will instructed his wife to invest 90 per cent of the money she inherits in a low-cost S&P 500 index tracker and the other 10 per cent in short-term government bonds.

Indeed, many studies have proven that few active fund managers outperform their benchmark.

Yet, during the Global Financial Crisis, when many so-called investors were fearful about buying into a “falling knife”, Buffet was a lone big investor buying.

He boldly wrote, “I’ve been buying American stocks,” in a New York Times opinion piece on Oct. 16, 2008.

What stands out for me is what he said so simply, “A simple rule dictates my buying: Be fearful when others are greedy and be greedy when others are fearful”.

He was right. Ten years after the fall of Lehman Brothers, the S&P 500 rose 130 per cent.

If you had invested just USD 1,000 in Apple in early August 2008, it will be worth 9X more in 2018, excluding dividends.

To be clear, Buffett’s strategy was not based on timing the markets. After his October call to buy, markets continued to fall in 2009.

That’s where a true investor (not a trader or gambler) finds opportunity by being focused on an investment time horizon of 1 to 3 years – and not a few days or weeks. This is how we designed SquirrelSave. Short term performance is not our focus. Medium to longer term risk management is our focus.

Buffett wrote in his 2018 shareholder letter, “Seizing the opportunities then offered does not require great intelligence, a degree in economics or a familiarity with Wall Street jargon such as alpha and beta. What investors need instead is an ability to both disregard mob fears or enthusiasms and to focus on a few simple fundamentals. A willingness to look unimaginative for a sustained period — or even to look foolish — is also essential.”

Conclusion

Take heed, as we now witness a financial opportunity during this fearful Covid-19. The challenge is how best to do it.

I say - be a true investor – not a gambler. Diversify. Pick a 1 to 3-year time horizon. Know your risk tolerance. SquirrelSave is one way. No human emotions. Just data-driven AI looking at possible higher returns, tied to your time horizon, age and risk tolerance. Stop gambling. Start investing.

Disclaimer

The contents herein are intended for informational purposes only and do not constitute an offer to sell or the solicitation of any offer to buy or sell any securities to any person in any jurisdiction. No reliance should be placed on the information or opinions herein or accuracy or completeness, for any purpose whatsoever. No representation, warranty or undertaking, express or implied, is given as to the information or opinions herein or accuracy or completeness, and no liability is accepted as to the foregoing.

More Articles more

Market Update Mar 2020

Team SquirrelSave

Major benchmark indices such as the Dow, S&P 500 and Nasdaq had the worst week since the Global Financial Crisis of October 2008.

Read more

Covid-19: Has Fear Run Ahead of Markets?

Team SquirrelSave

Greed and fear are the driving forces behind buying and selling decisions. We buy when there is an excessive greed. We sell when there is an excessive fear.

Read more

Covid-19: Defining Your Investment Experience

Team SquirrelSave

The IMF is forecasting a global recession in 2020. On the bright side, some analysts are forecasting a recovery as early as the third quarter of 2020.

Read more